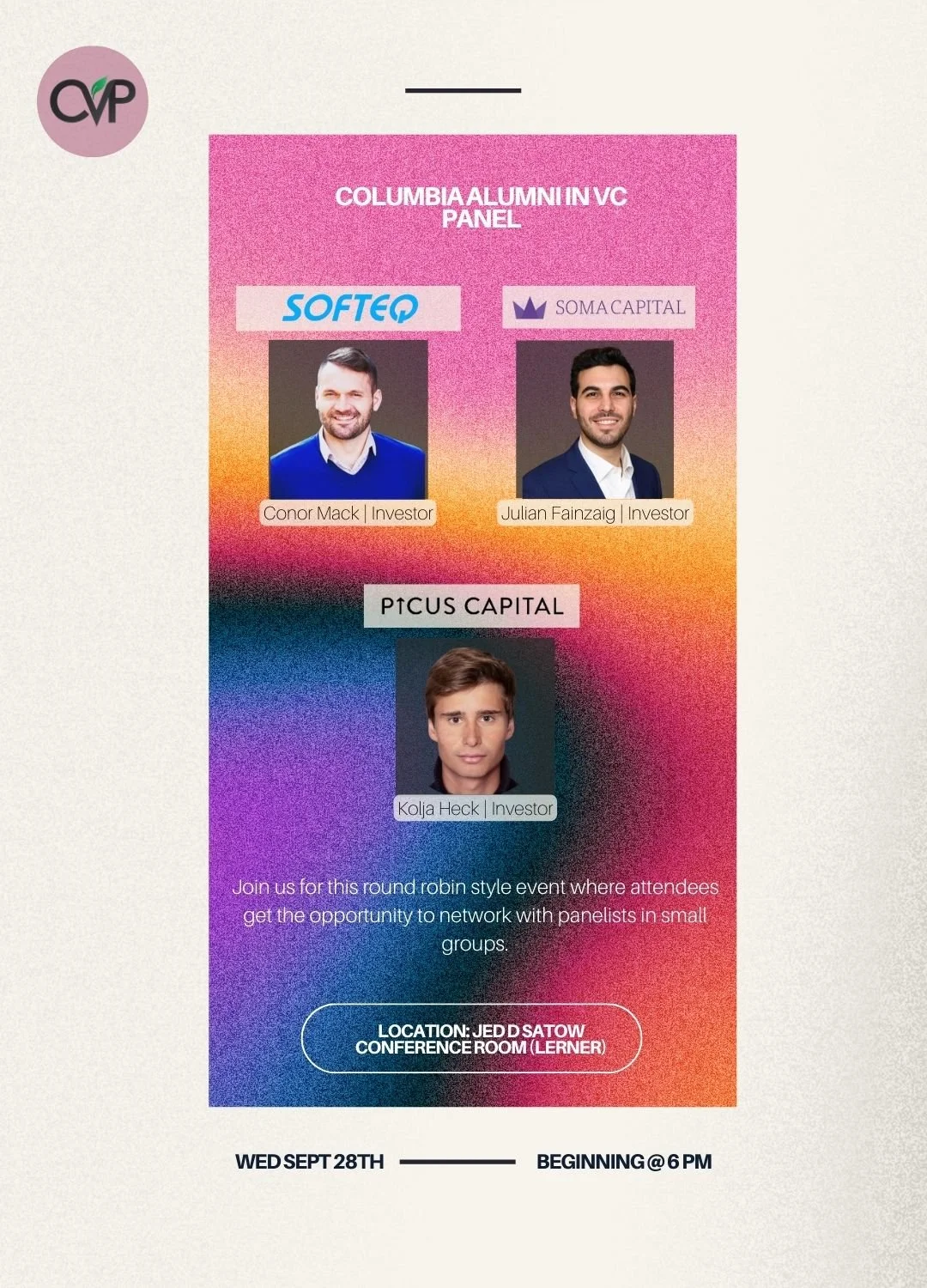

Sustainable Investment Panel

Interested in learning more about Sustainable Investing? Columbia Venture Partners is hosting a panel Monday, September 9th, to explore the transformative power of sustainable investing and its role in shaping the future of finance. Join us to gain insights from industry leaders on how investment strategies can drive environmental, social, and economic change.

September 9th

8-9 PM EST

RSVP Here